The only advice column that spins both sides of the truth, today’s topic: Advice Column 21, Dealing with concerns about partner’s size and tips for controlling spending and saving money

Q: My boyfriend ha s a small penis and I don’t know, if I should stay with him or leave him. I love him, but I’m not sure, if I can spend the rest of my life with him because of this. What should I do? And what should I tell him, if he asks why we’re breaking up?

Side A: Since you don’t have a definite answer about what to do, then you should try to work things out, at least. You can start with a discussion with him about how you’re feeling. Granted, this is a really sensitive subject, but you owe it to him to be honest. Besides, there are a few options for him to increase his penis size, such as penis stretchers. Penis stretchers are a great, cost-effective alternative to penis enlargement surgery. They are small, rectangular frames (undetectable underneath clothing) that are worn on the penis for a few hours, every day. The frames pull the penis to its maximum length. Ask him to give it a try! It may just be what you both need!

Side B: In order to know what you should do, you have to determine how important it is to you for your mate to be well-endowed. If it’s an absolute requirement, then you should move on. Otherwise, you should try to make it work with him. And regardless of whether you leave or stay with him, you owe him the truth. Just remember to be as kind and loving as possible to him, when speaking it.

Q: I have a major problem with spending money. I can’t seem to hold onto a dollar to save my life! Every time I turn around, I see something that I either have to buy or want to buy. I really want to get my spending under control. What can I do to spend less and save more?

Side A: There are two important rules that you need to know about spending less and saving more. The first rule you should know is, if you have to credit it, than forget it! If you can’t pay for an item in cash, then you probably don’t need to have it. Otherwise, you would have allocated the money to buy it. A credit card should only be used in case of an emergency and when you’re absolutely positive that you can pay the money back in a short period of time. The second rule you should know is that there is always money to be saved. It doesn’t matter, if you’re saving five dollars to five hundred dollars a month, just as long as you’re saving something. Most people assume that your savings account has to start big to be big and that assumption couldn’t be more wrong. The key is to save on a consistent basis. Besides, you can always increase the amount that you put away for savings. Personally, I started saving $50 a month. Recently, I increased that amount to $100 a month and if I stick to this amount, I’ll have $1,200 at the end of the year! See? Small sacrifice, big payoff. So, say “dead it” to the credit and start raving about saving!

Side B: There is a big difference between our needs and our wants. And you must understand this concept before you can truly get your spending under control. For example, you definitely need to buy food to eat, in order to survive. That dress you want from Bloomingdale’s with the matching shoes? Not so much. A dress and a pair of shoes won’t keep you alive. See my point? So, purchase only what you need, until you learn how to spend wisely. Place the money that you would have spent on the items that you wanted into your savings account. Once you’ve successfully saved for a year, at least, then perhaps take 10% of your regular contribution to your savings and use it to buy something that you want. At that point, you would’ve earned the right to spend and treat yourself to something nice.

– About Ms. Boogie:

Born a pineapple, bred an apple, and now, a peach, Ms. Boogie currently resides in Atlanta, GA. Besides writing, she also has an interest in radio broadcasting. You can find her on Facebook at https://www.facebook.com/joncierrienecker and/or follow her on Twitter @jrienecker.

Look out for the next “On The Beat” With Ms. Boogie, this has been Advice Column 21, Dealing with concerns about partner’s size and tips for controlling spending and saving money!

Readers May Also Like:

Are Drake & Sexyy Red Dating? — “Just Met My Rightful Wife.”

Tupac Shakur’s Gold Ring To Sell At Auction For Jaw-Dropping Price

Dwayne Johnson To Earn Highest Actor Payday Ever For Next Movie

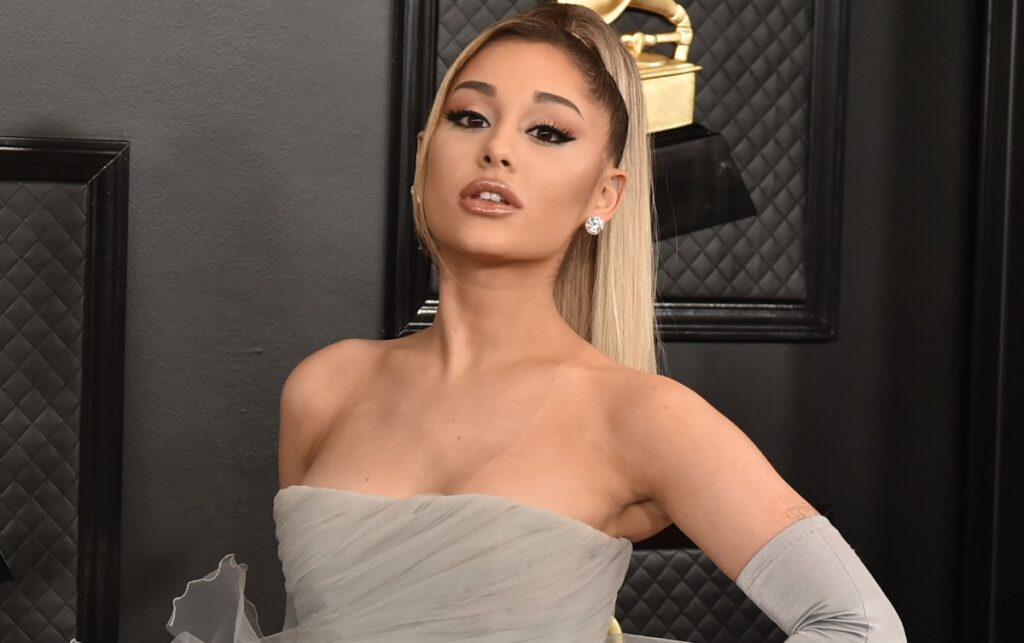

Ariana Grande & Her Husband Have Split Up? The Truth Is…